EMIR - Obligations for derivatives - Raiffeisen ENGLISH

Breadcrumb

Asset Publisher

EMIR - Obligations for derivatives

General information on EMIR for non-financial counterparties

EMIR is an abbreviation for European Market Infrastructure Regulation. EMIR provides legal framework for derivatives (e.g. futures and forwards, options, swaps) on European Union level. EMIR aims to address systemic risk posed by derivative markets by imposing risk-mitigating techniques and processes.

What kind of financial instruments covered by EMIR?

EMIR (European Market Infrastructure Regulation) covers derivatives that are traded either on exchanges or over-the-counter (i.e. ETD and OTC derivatives). However, not each and every EMIR obligations pertain to both kinds of derivatives.

What deals are classified as derivatives?

From financial point of view, derivatives are financial assets the value of which depends on the value of one or more underlying asset. For example:

- Forward or futures contracts

- Options (put, call, cap, floor, exotic options and option structures)

- Swap deals

The underlying asset of a derivative contract can be one or more of the following instruments:

- FX (foreign exchange)

- Interest Rate

- Equity (stocks)

- Index

- Commodity

- Other assets

Please, be aware that the above list in only a selection of some derivatives and does not intend to be a full list of derivatve contracts.

From legal point of view, EMIR Regulation (Regulation (EC) No 648/2012) provides the following definiton for derivatives:

- Derivative or derivative contract: a financial instrument as set out in points (4) to (10) of Section C of Annex I to Directive 2004/39/EC as implemented by Article 38 and 39 of Regulation (EC) No 1287/2006.

- OTC derivative or OTC derivative contract: a derivative contract the execution of which does not take place on a regulated market as within the meaning of Article 4(1)(14) of Directive 2004/39/EC or on a third-country market considered as equivalent to a regulated market in accordance with Article 19(6) of Directive 2004/39/EC.

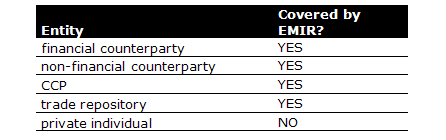

What entities are covered by EMIR?

- Financial counterparty:

investment firms, insurance undertaking, reinsurance undertaking, UCITS and its management company, institution for occupational retirement provision, alternative investment fund. - 'Non-financial counterparty'

- An undertaking established in the European Union that is not classifed as CCP or financial counterparty. e.g. in Hungary it covers legal persons like nyrt., zrt., kft., bt.

- CCP:

a legal person that interposes itself between the counterparties to the contracts traded on one or more financial markets, becoming the buyer to every seller and the seller to every buyer. - Trade Repository:

a legal person that centrally collects and maintains the records of derivatives.

Information about the protection levels and costs related to the segregation of the assets and positions held for the account of the Customer's (EMIR Article 39 (7))

Upon the Customer's request, Raiffeisen Bank shall open a segregated sub-account in the name of the Customer at KELER. The segregated sub-account shall ensure that the Customer's securities are kept record of at KELER - instead of the omnibus account (customer's financial instruments are held on the same account, together with other customer's financial assets) kept for the Bank - in a sub-account kept in the Customer's name, separately from the assets of the Bank's other customers. In the case of a legal dispute or liquidation proceedings, the owner of the securities and the quantity of the securities owned by them may be identified more easily this way.

The costs of the segregated KELER sub-account opening and the related ancillary services can be found in the List of Terms and Conditions of Investment Services.

What are the two categories of non-financial counterparties?

- Non-financial counterparties above the clearing threshold

- Non-financial counterparties below the clearing threshold

What does 'clearing threshold' mean?

Under EMIR two clearing thresholds are determined:

- EUR 1 billion - for OTC credit and equity derivaitives that are not objectively reducing risk (i.e. that are not for hedging purposes)

- EUR 3 billion - for OTC FX, interest rate, commodity and other derivaitives that are not objectively reducing risk (i.e. that are not for hedging purposes)

Regulation (EC) No 149/2013 sets out further details on how to calculate the clearing threshold.

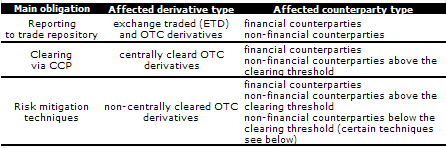

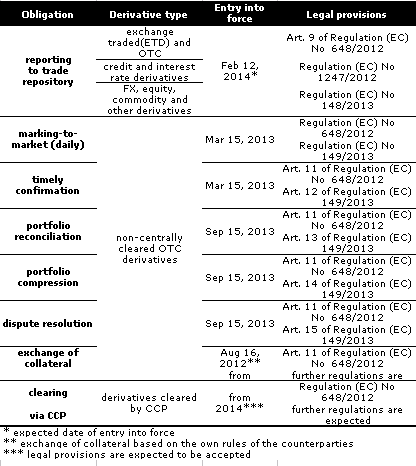

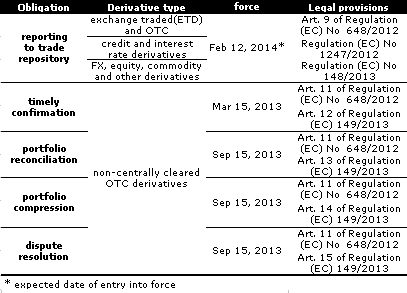

What are the main obligations under EMIR?

- Reporting to trade repository: Regulations (see below) provide standard forms that to be filled in and submitted to a trade repository. (Trade repositories are expected to be registered in H2 2013). Reporting covers not only those derivatives that are entered into by the counterparties in the future but those ones that were entered into in the past (even before Aug 16, 2012) if the deals meet the criteria set out by relevant regulations (see Regulation (EC) No 648/2012, 1247/2012 and 148/2013). The deadlines for these reports are also set out by these regulations.

- Clearing via CCP: Certain derivatives are to be cleared via CCP. The list of derivatives that are to be cleared via CCP has not been published yet(as of mid-June 2013).

- Application of risk mitigation techniques: As for non-centrally cleared OTC derivatives, the regulation lists the following risk mitigation techniques. Non-financial counterparties below the clearing threshold do not have to apply all of these techniques.

- timely confirmation

- portfolio reconciliation

- portfolio compression

- dispute resolution

- exchange of collateral

- daily MtM calculation

There are different dates for entry into force of the different risk mitigation techniques. These dates and the detailed description of these techniques are set out in Regulation (EC) No 648/2012 and 149/2013.

How to determine whether an undertaking is affected by EMIR Regulations?

1) The undertaking is a non-financial counterparty set out by EMIR?

- No -> EMIR obligations for non-financial counterparties does not pertain to the undertaking

- Yes -> EMIR obligations for non-financial counterparties does pertain to the undertaking if the undertaking's answer for Question Nr. 2 is 'yes'

2) Did the undertaking enter into an exchange traded or an OTC derivative contract (e.g. forward, futures, option, swap) before Aug 16,2012 that was still outstanding on Aug 16,2012 or did it entered into a derivative contract on or after Aug 16,2012?

- No -> the undertaking does not covered by EMIR

- Yes -> the undertaking is covered (or will be covered) by EMIR

If the undertaking has chosen Answer b) 'yes' for both questions of 1) and 2), the undertaking is covered by EMIR. Therefore it is advisable to determine what EMIR obligations does the undertaking have to meet.

3) The notional of the undertaking's derivative deals that are not objectively reducing risk (i.e. not for hedging purposes) reaches EUR 1 billion (in the case of credit and equity rate derivatives) or EUR 3 billion (in the case of FX, interest rate, commodity or other derivatives)?

- Yes -> EMIR obligations for non-financial counterparties above the clearing threshold (it is similar to the obligations of financial counterparties)

- No -> EMIR obligations for non-financial counterparties below the clearing threshold

What are the EMIR obligations for non-financial counterparties above the clearing threshold?

What are the EMIR obligations for non-financial counterparties below the clearing threshold?

What exemptions are possible?

- clearing obligation via CCP,

- exchange of collateral.

How can an undertaking prepare for EMIR?

- Step 1: The undertaking determines whether it is covered by EMIR and what EMIR obligations does it have to fulfil.

- Step 2: In the case of a non-financial counterparty above the clearing threshold the competent authority needs to be notified.

- Step 3: If the undertaking is entitled and wants to ask for exemption, then it asks for exemptions plus published information about it.

- Step 4: The undertaking decides whether it wants to report its derivative deals on its own toward a trade repository (list of trade repositories are to be published on ESMA homepage) or does it delegate reporting (e.g. via third party like a credit institution).

- Step 5: preparation for the application of risk mitigation techniques and application of them

Who can see trade reports data on derivatives and what data will be published?

What is the legal background of EMIR?

Implementing and regulatory technical standards:

Based on Nr. 2/2013 management letter of the Hungarian Financial Services Authority we call our customers attention for the fact that the Hungarian authorities are not entitled to interpret EMIR regulations. In order to promote common practices and consistent application of EMIR the European Commission and the European Securities and Markets Authority (ESMA) are entitled to issue opinion and guidelines on EMIR.

Information about the LEI code

The LEI is a reference code to uniquely identify a legally distinct entity that engages in a financial transaction. Currently, there are many ways to identify entities, but there is no unified global identification system for legal entities across markets and jurisdictions. The LEI is designed to be a linchpin for financial data - the first global and unique entity identifier enabling risk managers and regulators to identify parties to financial transactions instantly and precisely. It is mandatory for all counterparties to obtain LEI code to fulfill the requirements of EMIR regarding to portfolio reconciliation and reporting.

Further information about application for LEI code:

The above written was made only for providing information about EMIR on best effort bases. The Bank bears no responsibility either for the content of this document nor for the effectiveness of it. Please consult with your legal expert or consultant in order to get a comprehensive view of each and every details of applicable legal provisions and obligations.