3dsecure - Raiffeisen ENGLISH

Breadcrumb

Asset Publisher

In order to make card purchases over the internet safer, strong customer authentication is required. To this end, the Bank provides the myRaiffeisen application free of charge for all cardholders, which you can download to your mobile phone.

Using the application, cardholders can approve their online purchases not only safer, but also simply and conveniently.

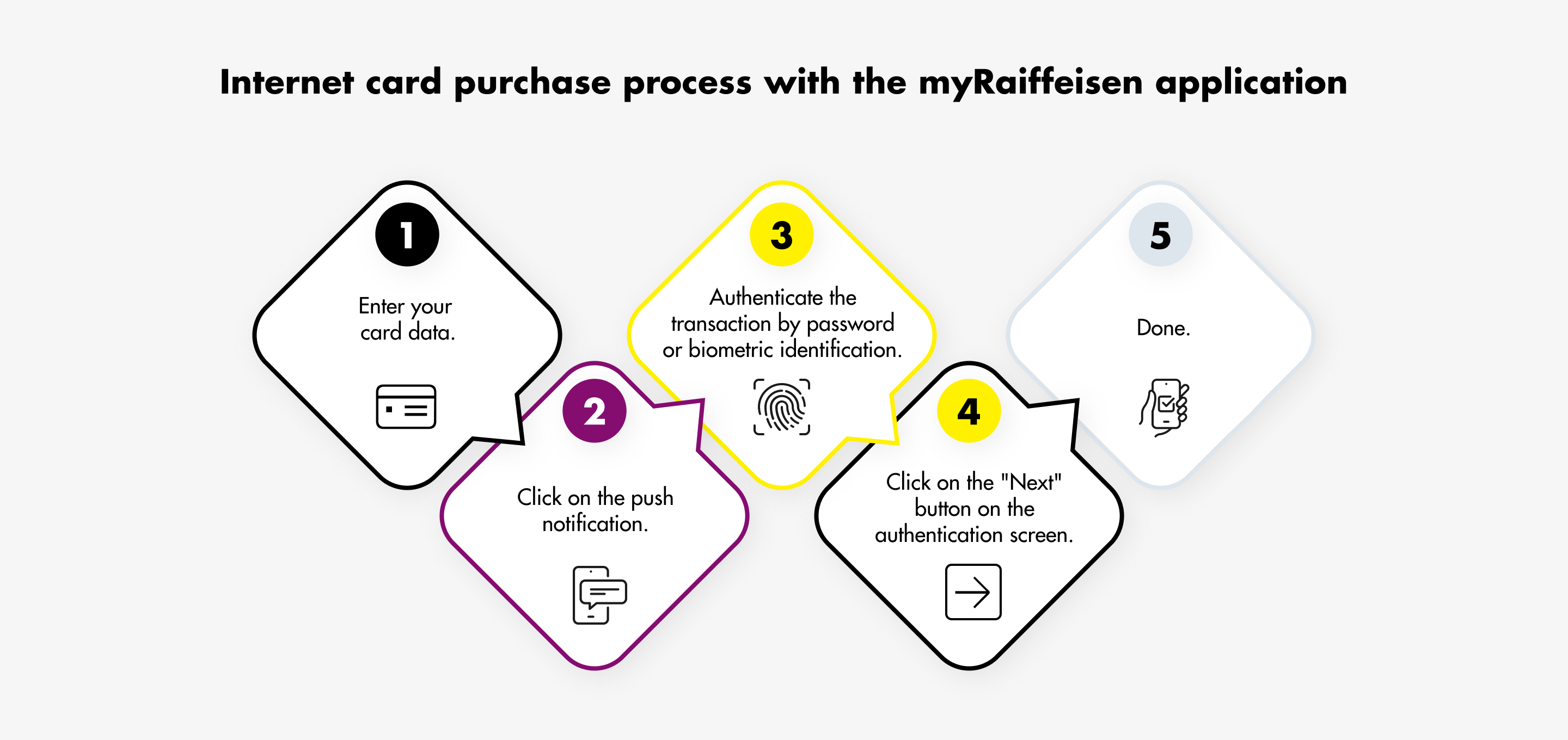

Internet card purchase process with the myRaiffeisen application

Download the myRaiffeisen mobile application** on your phone from the URL www.raiffeisen.hu/web/english/myraiffeisen-app or from the App Store/Google Play/Huawei App Gallery store.

Details:

1. After you have entered the card data (card number, expiration date, CVC code) in the merchant’s online payment platform, the authentication page operated by Raiffeisen Bank appears in the screen with detailed information.

2. Simultaneously, the cardholder gets a pop-up (push) notification to his/her mobile device.

3. The transaction can be authenticated through the myRaiffeisen application:

- by entering the Mobile Token PIN code chosen by the customer, or

- by fingerprint scan / facial recognition, provided that it has been authorised previously, and the device can handle it.

4. After this, the transaction must be finalised in the authentication page using the "Next" button.

5. That’s it!

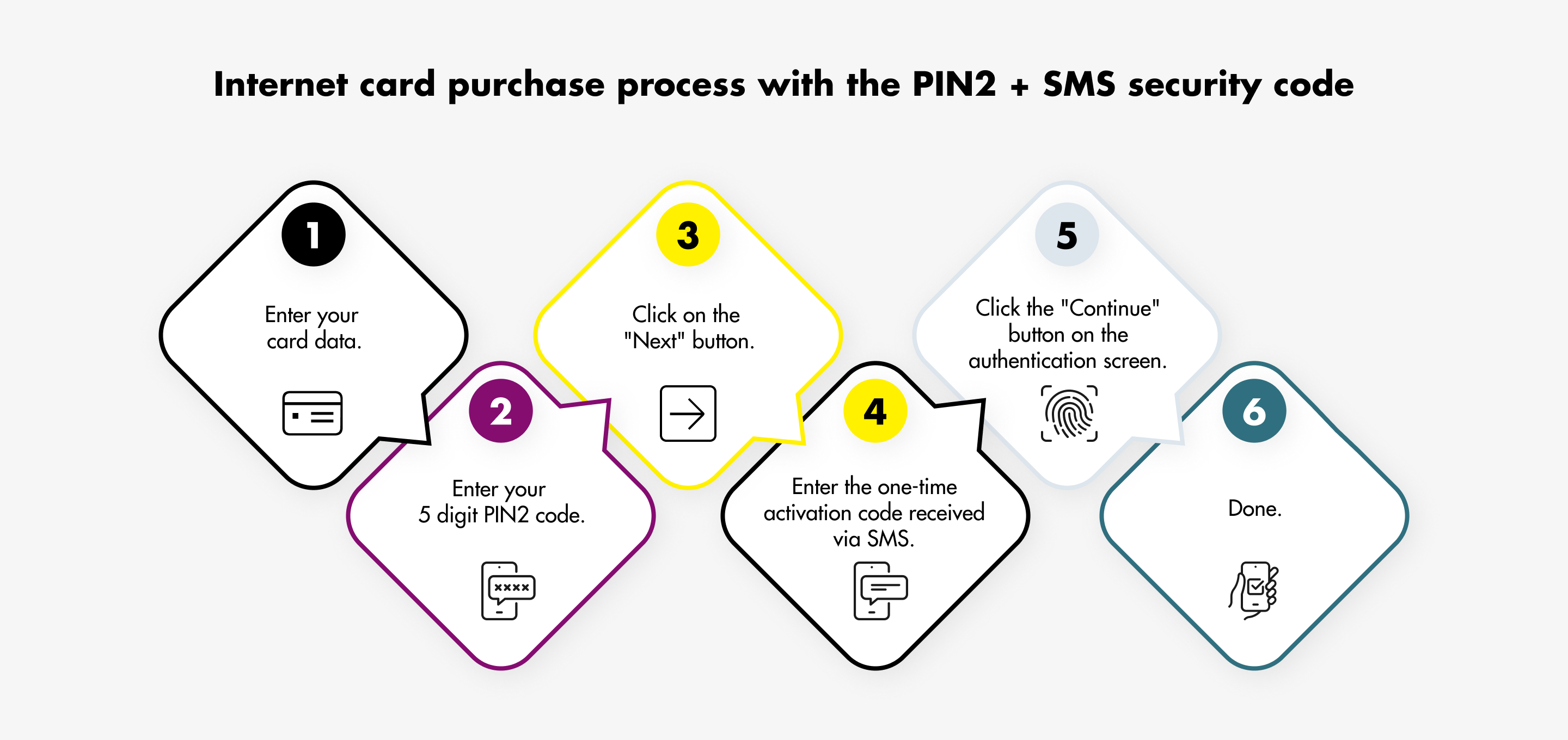

If installation of the mobile app is not possible, in that case as an alternative solution the payment can also be authenticated by entering the combination of PIN2 code + security code sent in SMS.

Details:

1. Click on the following link to create the PIN2 code: pin2.raiffeisen.hu.

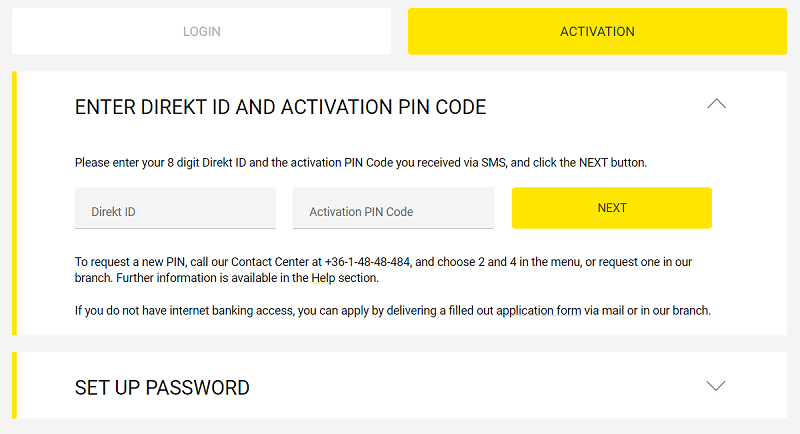

2. If you have not yet activated your Digital Channel access, open the Activation tab, where

- you can enter the Direkt ID, then

- enter the activation code received in SMS,

- create your password related to the Direkt ID.

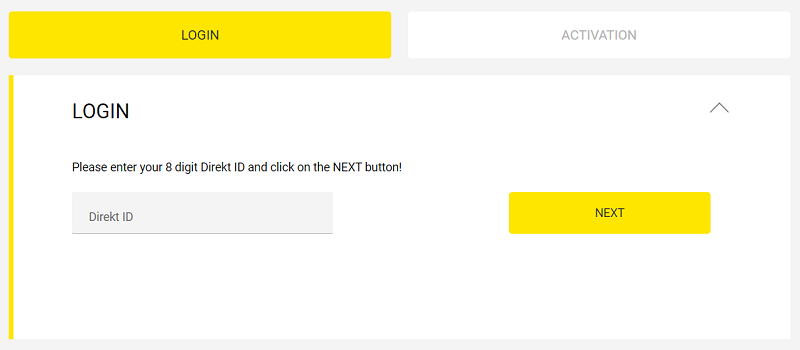

3. If you have already activated your Digital Channel access, click on the Login tab, where

- you can enter the Direkt ID, then

- enter your password,

- enter your one-time password sent in SMS for the login.

4. After login you can enter the PIN2 code, which you will be required to authenticate with your password linked to the Direkt ID and a one-time SMS code sent to you for this purpose.

5. THAT’S IT! Now you will be able to approve your internet purchases without the application, by entering the PIN2 + SMS codes.

If you have forgotten the PIN2 code you have set in the system, you can create a new one at any time, even during shopping or use myRaiffeisen application to approve future purchases.

Frequently Asked Questions

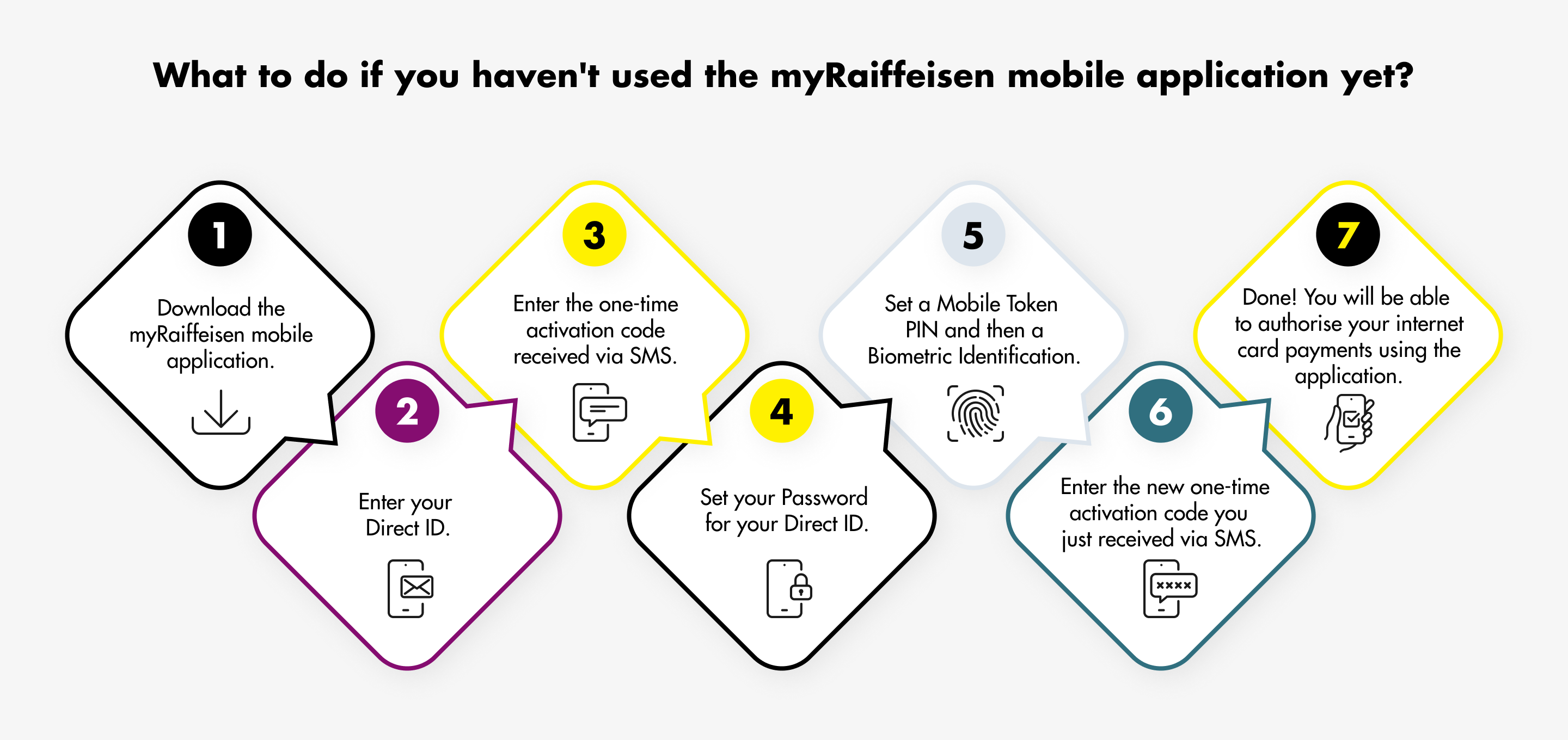

If you have not yet installed the myRaiffeisen application, please act as follows:

1. Download the myRaiffeisen mobile application** on your phone from the URL www.raiffeisen.hu/web/english/myraiffeisen-app, or from the App Store/Google Play/Huawei App Gallery store.

2. Enter the Direkt ID in the myRaiffeisen app.

3. Enter the one-time Digital Channel activation code received from the Bank.

4. Create a Password for your Direkt ID.

5.Choose any Mobile Token PIN code (consisting of 5 digits) and remember it. Later on you may as well authorise your payments by fingerprint or facial recognition.

6.At this point you will receive a one-time SMS code necessary to activate the Mobile Token; please enter this SMS code in the myRaiffeisen mobile app.

7.THAT’S IT! Now you can approve your purchases in the internet through the application.

In order to ensure that the new authentication method works on your phone, please be aware that the latest version of the app is running on your device in the Google Play Store, App Store, or Huawei AppGallery, and please enable notifications reception.

Where can I find my Direkt ID?

In the case of customers who also have a Direkt and / or DirektNet service, the Direkt Identifier can be found on the service application form or in a letter previously sent by post by the Bank. If you can't find your ID, call our Raiffeisen Direkt telephone customer service at + 36-80-488-588

Where can I find the Digital Channel activation code?

A one-time Digital Channel activation code is needed for the activation if the cardholder does not use the Direkt and/or DirektNet service. In such case the Digital Channel activation code is included in the SMS sent to the cardholder.

What should I do if I have already installed the myRaiffeisen mobile app?

Cardholders who already use the myRaiffeisen mobile app as a method of authentication are able to access in the myRaiffeisen application all cards issued by Raiffeisen Bank, and consequently to approve their internet card purchases through the application.

How can I subsequently request a Digital Channel activation code?

You can request a new Digital Channel activation code through our call centre Raiffeisen Direkt, after proper identification, or in-person at any branch.

What functions are accessible in the myRaiffeisen application for cardholders?

- From the functions of the myRaiffeisen application, cardholders who do not have DirektNet access are only able to use the function serving to authenticate card payments, and to view executed card transactions.

- Cardholders who have DirektNet access as well are able to use the whole range of functions of the myRaiffeisen application.

What should I do if I have several roles?

You can view any of your Raiffeisen cards belonging to all your roles within the myRaiffeisen application. Since you have several Direkt IDs, you need to activate only one of these, and you will be able to approve the online payments executed with all your cards. To use the application, however, you should activate minimum one access.

What should I do if I my mobile number has changed??

If you have not registered your mobile phone at the Bank, or if your telephone number has changed in the meantime, or if any problem should have arisen during the download or installation of the application or during the identification, please contact:

- your personal advisor at the Bank, or

- call our telephone customer service with your identification codes at phone number +36-80-488-588. or

- visit any of our branches

What should I do if I did not receive pop-up notification on my mobile phone?

If you use myRaiffeisen application to confirm your online purchases and you do not receive the pop-up notification, proceed as follows:

- open the application and select Sign transactions in the Actions menu or

- update your timeline and select Sign Transactions

What should I do if the myRaiffeisen application is not available?

If the online purchase is urgent and the myRaiffeisen application is not available, we recommend to switch to PIN2 + SMS authentication until the start of the payment. If you have DirektNet access, you can change the approval mode by disabling Mobile Token Authentication in the Administration / Mobile Token Settings menu.

For customers who do not have DirektNet authorization, our Raiffeisen Direkt telephone customer service (+ 36-80-488-588) can temporarily suspend or cancel the Mobile Token, after which the authentication process will automatically go through the PIN2 + SMS branch.

What happens if I enter the PIN2 SMS security code erroneously?

If you have entered an erroneous PIN2 or SMS security code, the transaction will fail. You can restart the authentication in the website of the online trader or card accepting merchant.

If the authentication of the transactions fails five consecutive times, for security reasons no more internet payments will be allowed with your card until the end of the day, we will send you notification about it via SMS. The prohibition will be lifted at 0:00 midnight, and on the next day you will be able to use your card again for internet payment.

During the temporary prohibition you will still be able to pay via POS terminals or cash in/out from ATMs.

Why is strong customer authentication necessary?

The PSD2* directive requires in the course of purchases initiated online (in a remote channel) that banks use at least two identification elements simultaneously to ascertain the identity of the originator. By means of strong customer identification both the Bank and the merchant can make sure that the payment transaction was indeed initiated by the cardholder.

The procedure is supposed to ensure—in the interest of the users’ protection-that only the person authorised to use the card, i.e. the cardholder, may authenticate the transaction.

When is it not necessary to confirm an internet card purchase with strong customer authentication?

- The new rules do not apply to card purchases in websites operated outside the European Economic Area (typically in Asia or the United States).

- For transactions considered low risk, payments not exceeding the HUF equivalent of EUR 30 or EUR 30 calculated at the Bank's HUF/EUR mean exchange rate for retail customers, provided that no more than 5 such purchases are made in a row. If the currency of a transaction in this category is other than HUF and EUR, the Bank shall first calculate the amount of the transaction in HUF at the mean rate for retail customers of the currency/ HUF and then shall calculate the amount of the transaction in EUR as set out aboveIn the case of recurring transactions (e.g. subscriptions) strong customer authentication is needed only when the authorisation is given, and it is no longer necessary in the case of the further transactions. If you have given such an order previously—prior to the introduction of the security code—it is not necessary to give the authorisation repeatedly.

- In the case of so-called MO/TO (Mail Order/Telephone Order) purchases, again no strong customer authentication is required. In the case of these transactions the card purchase takes place in the cardholder’s absence, on the basis of his/her written or telephone order, and the data provided by the cardholder are recorded manually by the accepting entity. The cardholder of course has to consent to the use of the data, and the storage of the card data in any form after the transaction is completed is subject to enhanced security requirements.

* Directive (EU) 2015/2366 on payment services in the internal market (PSD2 directive).

**You need a mobile phone with an Android 7.0, iOS 13.0 or later operating system, which also has internet access.